Kenya is looking for US investors to save its airline

Date 2022/12/17 14:49:34 | Topic: Kenya

|

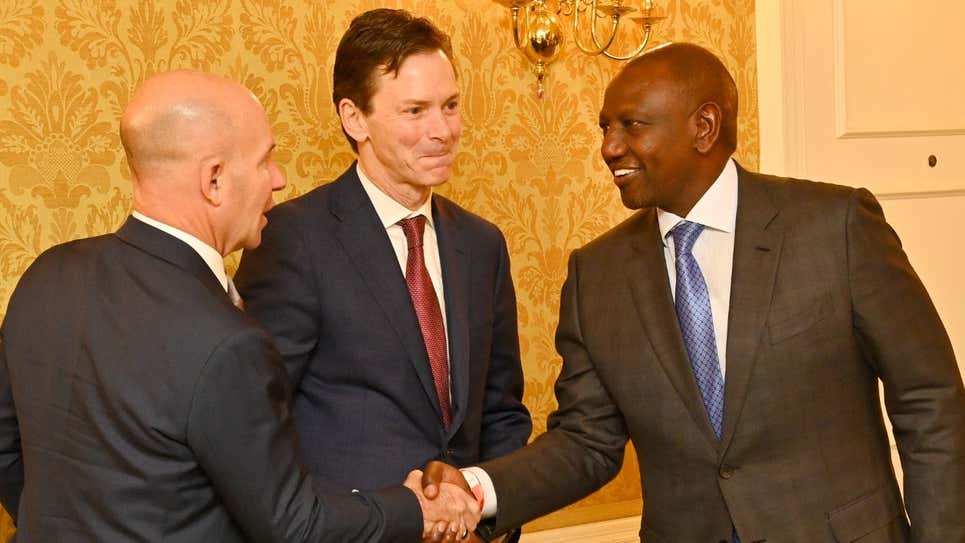

President Ruto hopes Delta Air Lines will help him fly Kenya Airways into financial stability in his first year in office.

Kenyan president William Ruto attended the Washington US-Africa Business Summit with one of his major goals being to get investors to turn around the fortunes of the country’s national carrier Kenya Airways which last recorded profits 10 years ago.

ADVERTISEMENT

Ruto identified a potential investor in Delta Air Lines, holding discussions with the carrier’s executive vice president for external affairs Peter Carter “on building partnerships to make both airlines competitive and attractive.”

After it made net earnings of $15 million in 2012, Kenya Airways has since been a loss-making airline, sinking deeper into financial turbulence with a net loss of $82.4 million in the half year to June 2022.

The airline's early woes were blamed on mismanagement and poor investment decisions. More recently, similar to other airlines, Kenya airways’ business was contracted by the 2020 and 2021 global covid-19 lockdowns and travel restrictions, and has been unable to recover, with CEO Allan Kilavuka telling Quartz in 2021 that the airline was “hardly hit” and “if you don’t fly for a single day, you lose close to a million dollars.”

Product Hunter

It has been loss after loss for Kenya Airways since 2012

Tax payers have been consistently bailing out the airline but its books remain in total disarray, with total revenue slumping by 58.9% to $481 million while accumulated losses rose to $585 million last year.

It is such figures that made Ruto pitch to Delta Air Lines, world’s second largest airline with over 870 aircrafts and 5,400 daily flights, about a possible capital injection into Kenya Airways in an attempt to save the airline in his first year in office. Delta projects its revenue will grow two-fold from $2 billion to $4 billion in 2023.

Kenya’s Transport minister Kipchumba Murkomen said the government no longer wants to finance Kenya Airways using public funds and would be happy to find a stable investor to lift the airline out of insolvency.

“We are doing everything possible to ensure that we no longer subsidize the airline and that is why we are looking for a strategic partner,” said Murkomen.

Strikes are tainting Kenya Airways’ reputation

In November, a strike by Kenya Airways staff and aviation workers paralyzed operations at the Jomo Kenyatta International Airport, leaving over 1,000 passenger stranded after 53 flights destined for regional and international travel were cancelled. The workers’ grievances involved unpaid pensions and accrued back salaries.

Kilavuka said the airline ferries 250,000 passengers and 5,800 tons of cargo per month. “This strike action will cost KQ approximately $2.5 million per day,” Kilavuka said. The strike ended after a court order four days later.

The airline said it is unable to continue paying $15.9 million in pension contributions and clear $79.9 million in outstanding salaries due to its depressed revenues.

But it remains to be seen if Delta will commit to helping Ruto reclaim his country’s national carrier image of “the pride of Africa”, given that investments by KLM and Air France have yielded little to fly it to liquidity.

|

|